Unlocking the First Home Guarantee Scheme: Buy Your First Home with a 5% Deposit

The First Home Guarantee Scheme (FHGS) is one of the most powerful tools available to help first home buyers enter the market with less deposit, avoid paying lenders mortgage insurance (LMI), and get into their first home sooner.

In this resource, we break down exactly how the scheme works, who’s eligible, what’s changing in October 2025, and how to use it strategically. We also cover the other key schemes under the same government initiative: the Family Home Guarantee.

This resource supports Episode 10 of the First Home Unlocked podcast, part of our Grants & Schemes Series.

What Is the First Home Guarantee Scheme (FHGS)?

The First Home Guarantee (FHGS) is a federal government initiative run by Housing Australia. It’s designed to help eligible first home buyers get into the market sooner, with as little as a 5% deposit and pay no Lenders Mortgage Insurance (LMI).

But here’s where people often get confused:

You’re not receiving money from the government, and they don’t contribute to your deposit.

Instead, the government acts as a guarantor behind the scenes, covering up to 15% of the property’s value. This means when you apply for a home loan with a 5% deposit, the lender treats it as if you’ve contributed 20%, because Housing Australia is guaranteeing the remaining portion.

What That Means for You:

You don’t pay Lenders Mortgage Insurance (which can be tens of thousands)

You still get access to competitive interest rates

You own 100% of the property, the government doesn’t own any share

You can enter the market sooner, without needing to save a full 20% deposit

What Does “Guarantee” Actually Mean?

In this context, a “guarantee” doesn’t mean extra protection for you, it’s a promise made by the government to your lender.

If you ever default on your home loan and the property is sold for less than what’s owed, Housing Australia may cover the shortfall, up to 15% of the original property value. This reduces the lender’s risk, which is why they waive LMI.

What the Guarantee Does Not Do:

It doesn’t reduce the amount you borrow

It doesn’t mean the government pays your loan

It doesn’t protect you if you can’t meet repayments

It doesn’t stop your lender from taking action if you fall behind

So while the guarantee helps you get a foot in the door with less deposit, you’re still responsible for 100% of your loan and repayments, just like any other borrower.

That’s why it’s so important to work with a broker to make sure the repayments are manageable and the property fits your long-term plans.

Who’s Eligible?

To qualify for the scheme, you need to meet the following criteria:

Be 18 or older

Be an Australian citizen or permanent resident

Apply alone or with one other person

Earn under $125,000 (single) or $200,000 (couple) per year

Note that the income caps will be removed from Oct 2025Be a first home buyer, or not have owned property in the last 10 years

Have at least a 5% deposit saved (from genuine savings)

Be planning to live in the home (not an investment)

Meet the scheme’s property price caps for your location

You can use the Housing Australia Price Cap Tool to check your suburb.

Live-In Requirements

To be eligible, you need to live in the property as your home, not use it as an investment.

You must:

Move in within 6 months of settlement (for existing homes), or

Move in within 6 months of receiving your occupancy certificate (if building)

Continue living in the property as your principal place of residence

If you later move out or rent the home out, the guarantee may no longer apply, and your lender could require you to pay LMI or adjust your loan. So this scheme is designed for people who plan to live in their first home.

Once your loan-to-value ratio (LVR) drops below 80%, you can refinance the loan and may then be able to use the property as an investment once the guarantee has been removed.

How Much Deposit Do You Need?

To qualify for the scheme, your deposit must be between 5% and 20% of the property price.

Most lenders also require that your deposit is genuine savings.

That usually means:

The funds have been in your account for at least 3 months

Gifted or transferred funds won’t count unless they’ve been held long enough

Genuine savings show the lender that you can manage money consistently. It’s a non-negotiable part of the application for most banks under the scheme.

It’s Not Just the Deposit

Even with just a 5% deposit, you still need to budget for other upfront costs like:

Stamp duty (varies by state)

Lender fees

Conveyancing or legal costs

Building and pest inspections

Moving costs

Furniture and home setup

A buffer, so you’re not left with nothing after settlement

We covered all of these in detail back in Episode 3, so if you haven’t listened yet, it’s worth checking out before you buy.

What’s Changing from October 2025?

The federal government has announced some major updates to the First Home Guarantee Scheme and they’re coming sooner than expected.

Originally set for January 2026, the changes will now take effect from October 1, 2025:

No income caps

Previously, buyers had to earn under a certain threshold to qualify. From October, those income limits will be removed — allowing more high-income earners to access the scheme.

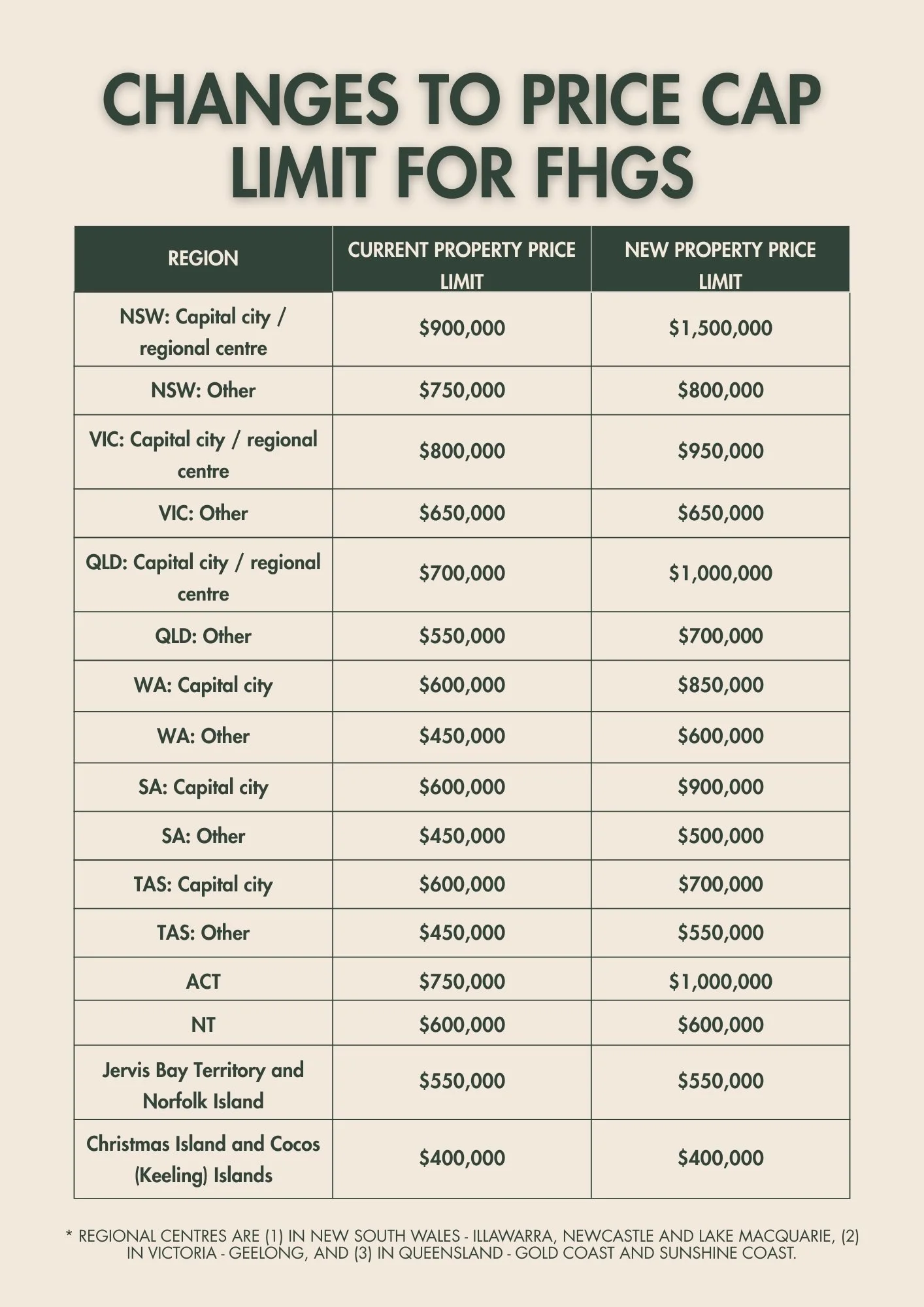

Higher property price caps

Price caps are increasing to better reflect the current market, giving first home buyers access to higher-quality homes in more areas.

No more place limits

The 35,000 annual place limit will be removed, so if you’re eligible, you won’t miss out just because the cap has been reached.

What This Means for First Home Buyers

These changes are exciting. They’ll give more buyers access to the scheme and make it easier to find a home that fits your needs, especially in higher-demand markets.

But there’s another side to the story.

When more buyers are competing for the same number of homes, and the scheme is making it easier to purchase, prices and pressure can increase. We’ve seen this happen before when schemes expand or grants are introduced.

That’s why it’s important not to rush.

Instead of reacting with urgency, now is the time to plan with clarity:

Know your borrowing power

Get pre-approved early

Clarify your budget and asset strategy

Be ready to act when the right home comes along

Schemes like this are great tools, but they shouldn’t drive your entire decision. Your property decision needs to come back to your goals and visions.

Family Home Guarantee (FHG)

The Family Home Guarantee is a government backed scheme that helps eligible single parents buy a home with just a 2% deposit, even if they’ve owned property in the past. To qualify, you must:

Be a single parent or legal guardian

Have at least one dependent child

Earn under $125,000 per year

Not currently own property (you don’t need to be a first home buyer)

Under this scheme, the government guarantees up to 18% of the property’s value — meaning your lender treats your 2% deposit like a 20% deposit. That means:

No Lenders Mortgage Insurance (LMI)

Access to competitive interest rates

Just 2% deposit needed to buy a home

Can I Refinance Under the Scheme?

Yes, but there are rules.

If you’re already using the First Home Guarantee and want to refinance, you can only do so with another Participating Lender.

Here’s how it works:

You can refinance to get a better interest rate or home loan product

You can’t increase your loan amount or make changes to the term

If you refinance with a lender that doesn’t participate in the scheme, you’ll lose the guarantee and may need to pay LMI

Once your loan-to-value ratio (LVR) drops below 80%, you can refinance like normal, without relying on the scheme at all.

How to Remove the Guarantee

The guarantee stays in place until your loan-to-value ratio (LVR) drops below 80%, meaning you own at least 20% of the property. This can happen in three main ways:

Paying down your loan through regular or extra repayments

Property value growth increasing your equity

A combination of both

Once your LVR is under 80%, you can:

Refinance to any lender (not just scheme participants) without paying LMI

Potentially access better rates and products

This removes the guarantee completely and allows you to access the full range of lender options.

Final Thoughts: Should You Use the Scheme?

If you're eligible and want to get into the market sooner, this scheme is worth serious consideration. It can:

Save you tens of thousands in LMI

Help you buy sooner

Open access to more lenders and better rates

From October 2025, it’s likely that competition will increase. So if you’re on the fence, now might be the perfect time to act before more buyers flood the market.

As always, it's important to get tailored advice and explore your options with someone who understands the full picture.

Book a Free Chat

If you’re thinking about using one of these schemes, we’d love to help.

Book a Get to Know You Chat to find out:

What you're eligible for

How much deposit you’ll need

Whether now is the right time to buy

We’ll help you build a clear, calm, and confident plan to unlock your first home.